Table of Content

- Checking Vs Financial Savings Account

- Account Withdrawal Limits

- How To Earn Interest With A Compounding Interest Invest…

- A Few Of The Highest-yield Financial Savings Accounts Right Now

- What Can I Count On From A Financial Savings Account?

- High-yield Savings Accounts Vs Money Market Accounts

- What Is A Money Market Account?

It explains in more detail the traits and dangers of trade traded options. Ally Invest does not present tax advice and does not characterize in any manner that the outcomes described herein will lead to any explicit tax consequence. You can belief the integrity of our balanced, unbiased monetary recommendation. We could, however, receive compensation from the issuers of some products mentioned on this article.

Since you are imagined to be saving cash, you're limited to solely 6 withdrawals or transfers every month. When it comes to saving money, most individuals want to know how much interest they will earn on their deposited funds. Information provided on Forbes Advisor is for academic purposes only. Your monetary scenario is exclusive and the services and products we evaluate may not be proper on your circumstances. We don't supply monetary advice, advisory or brokerage services, nor can we advocate or advise people or to buy or sell explicit stocks or securities. Performance info might have modified for the rationale that time of publication.

Checking Vs Financial Savings Account

If you had been to lose all your money out of your money market fund, tough luck. Thus, stagger your savings into accounts that are increasingly much less liquid however pay more. Putting round 60-70% of your financial savings away for the long run is a stable move. You could even throw them into a CD ladder to keep up liquidity. If you might be snug locking in your cash for a set time period to get the next APY, you might also look into investing inCDs with high rates. If you dip below the minimum, you might sacrifice your higher rate of interest for a lower one or trigger a monetary penalty.

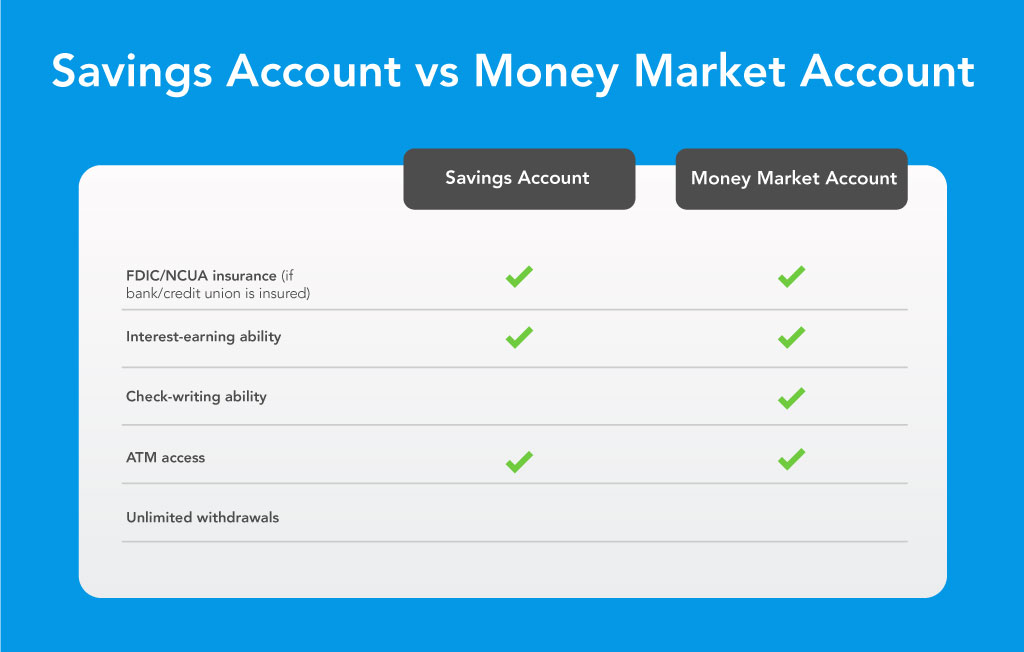

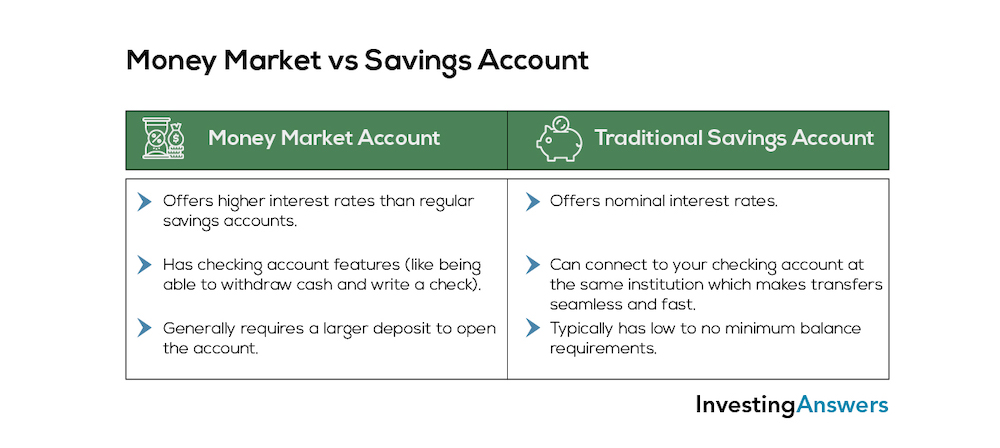

Money market accounts are offered by banks and credit unions and sometimes present check-writing privileges along with debit playing cards. However, in exchange, some banks may have larger account balance and/or minimal deposit requirements. Money market accounts and high-yield financial savings accounts could give you great interest rates, but additionally they provide you with an excessive amount of flexibility to withdraw money. Long-term financial savings objectives are some of the most important financial savings commitments you might make, and also you wish to do everything in your energy to avoid siphoning the cash you’ve put away.

Account Withdrawal Limits

Since you presumably can withdraw money from it easily and it doesn't earn a lot, a financial savings account is well-suited to short-term goals—a place to park funds till your holiday or a giant buy. Money market funds have a tendency to offer greater returns than cash market accounts. Savings accounts and cash market funds act considerably equally but are literally quite completely different.

Terms can range from 30 days to 10 years or longer depending on who you do business with. The longer the term, the upper interest you typically will earn. Once a CD matures , you can withdraw the money together with interest. High-yield saving accounts even have the identical FDIC or NCUA protections in case of bank or credit union failure, as much as $250,000 for individuals or $500,000 for joint accounts.

She holds a Bachelor of Science in Finance diploma from Bridgewater State University and has worked on print content material for business homeowners, nationwide brands, and main publications. In the unlikely event that the brokerage goes bankrupt, you might have hassle taking possession of your funding. Instead, the insurance coverage protects buyers against the failure of the brokerage holding your property.

You also shall be limited to a set variety of transactions every month. To open a cash market account, you sometimes need to deposit a specified quantity and will have to maintain your balance above a threshold to avoid month-to-month service charges. However, some high-yield financial savings accounts haven't any monthly minimums or month-to-month fees. The main difference between the money market and high-yield savings accounts is the entry they provide to cash. As mentioned, money market accounts present buyers with chequebooks, whereas saving accounts don't have the identical possibility.

A Few Of The Highest-yield Savings Accounts Proper Now

By laddering CDs, you'll be able to maximize your curiosity earnings while avoiding early withdrawal penalties. Savings accounts supply full security, which is right for money that you simply can’t afford to lose. Keep roughly three to six months residing bills in your emergency fund.

Some money market and high-yield financial savings accounts provide interest rates of zero.80% or even 1.25% . This may not compete with the current inflation fee however might assist fight it to a point. Money market and high-yield financial savings accounts are FDIC insured for up to $250,000 per person, permitting the insurance protection to stack for joint accounts. This insurance coverage would cowl you as a lot as that limit in case your financial institution or credit score union was to fail for some purpose.

You can make an in-person visit and complete a withdrawal kind, receiving a verify or money for the amount you need to withdraw. You can also access funds by transferring money digitally out of your savings account to a checking account through the bank’s online portal. A low-interest standard financial savings account with a low stability requirement should be nice for you. A cash market account could be extra lucrative if you’re going to maintain your cash in financial savings for an extended time frame. Another beauty of a money market account is that, like all bank accounts, they’re federally insured as a lot as $250,000. If your bank or credit score union goes underneath, your money will be protected up to the insured amount.

People have a tendency to make use of MMAs for long-term financial savings they do not plan to touch, and high-yield financial savings accounts for shorter-term monetary objectives. Money market accounts, or MMAs, are also a sort of financial savings account offered by banks and credit score unions that are federally insured. MMAs generally have more aggressive APYs in comparison with savings accounts.

While these limits are set by federal regulation and not by the individual financial institution, banks and credit unions may still select to impose a charge for exceeding the identical old restrict. Like a money market account, a financial savings account lets you deposit cash, earn curiosity and save up for brief and long-term monetary objectives. A financial savings account usually offers the next rate of interest than a checking account, serving to your cash grow sooner. Savings accounts, money market accounts and CD accounts might be good financial savings options for those seeking safety and curiosity earnings. But contemplate access to your money when selecting between the three. Both financial savings accounts and MMAs offer a limited variety of monthly withdrawals and transactions, offering some liquidity.

Before digging into which savings choice offers the best rates, it’s helpful to know how charges are set in the first place. Money market funds are mutual funds that pool money from a number of investors into totally different funding vehicles. Money market funds offer a small increase in potential return but make it tougher to entry your cash and introduce some danger to the equation. Once you might have some cash you'll find a way to afford to place at a slight danger, you'll have the ability to open a money market fund. It is very unlikely that you will lose any money you’ve deposited into a financial savings account.

No comments:

Post a Comment